Please feel free to browse our pre-recorded videos and other pre-conference materials or set up your 1:1 meetings prior to the start of our event.

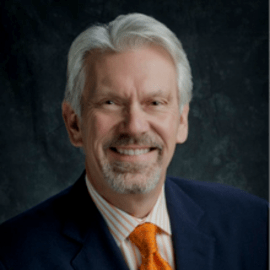

A conversation with Dennis Haslam, Board Director, Larry H. Miller Group of Companies

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.

What private company governance lessons have been learned in the past year, and how can boards even better serve the needs of their shareholders and stakeholders? PCGS will look at how private company boards can become even more useful—and essential—to the success of the companies they serve. Topics to be addressed include risk management and supply-chain issues, as well as getting the right people on your board, assessing your governance needs and more.

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.

Leading a company is challenging in any year, but 2020-21 has been more stressful than any year in recent memory. CEOs relied more heavily on their boards, or a “kitchen cabinet” subset of directors. How can a board be the best possible mentors for the CEO? How can directors determine what form of emotional support will be the most helpful?

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.

This session will present a deep dive into anticipating and planning the evolving governance of a company. Topics to be discussed include board skills and structure, succession planning, board evaluations, and the balance between shareholder and company needs.

Shareholders who join a board, particularly in the case a family business, may not be well versed in the duties and responsibilities of board service. How can experienced directors help develop shareholders for board service and mentor shareholder-directors who are new to the board?

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.

Join us for a presentation of the winners of the 2021 Private Company Boards of the Year Awards. Hear from the chairs of each of the winners as they discuss the role of good governance to their companies.

Presented by Bob Rock, Chairman, MLR Holdings LLC, and Publisher of Directors & Boards

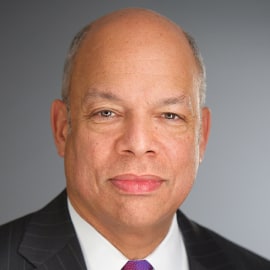

A conversation with Secretary Johnson, Board Director, Lockheed Martin and U.S. Steel; former Secretary of Homeland Security (2013-2017); current partner in the law firm of Paul, Weiss, Rifkind, Wharton & Garrison, LLP.

This session is focused on understanding how to establish an effective recruiting process, the perspectives of both the company and candidate, and resources to achieve the desired result.

This session will take a case study approach to discuss three critical questions:

- What’s the family’s vision for the enterprise long-term?

- Where does shared ownership create complexity?

- How do governance models need to evolve as complexity grows?

This session will look at whether it is time to sell, how to position the company for the sale, identifying the right buyer and next steps. It will also examine options such as a partial sale and other considerations.

What should your board be focused on, and why? Panelists will discuss how to consistently and objectively assess the needs of the company, and adjust board composition and the board agenda accordingly.

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.

This session will examine why private companies should build a robust ESG plan and explore the importance to investors, regulators, employees and stakeholders.

This session will review the 2021 Incentive Pay Practices survey, completed by 560+ privately held companies.

Best practices, including governance, strategy, talent, culture, etc. that make some private companies stand out as “the best.”

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.

Trust drives enterprise performance. The session will review a structured approach to enhancing trust within an organization.

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.

A conversation with Christie Hefner, Chairman of the Board, Hatchbeauty Brands

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.

Private companies face an array of risks: those encountered in day-to-day operations, long- and short-term strategic risks, and challenges related to the shareholder group, such as projected growth of the family or an investor who is likely to seek an exit. How can boards help companies manage their risks?

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.

A conversation with Duncan A.L. MacLean, President & CEO MacLean-Fogg

Please note: You can ask questions anytime during the presentation using the Q&A box. Questions will appear as “waiting for review.” We will get to as many questions as possible.

If you prefer, you can minimize the Q&A window.